Tax Saving Schemes (ELSS)

Tax saving schemes is the best way to make investments and save tax, but it is equally important to choose the correct instrument. Here are two main avenues to save tax:

Invest Rs. 1,50,000 in ELSS – Tax saving schemes of mutual funds and save tax upto Rs. 46,800* u/s 80C

• Highest return potential amongst all tax saving schemes

• Lowest lock-in period of 3 years

• Investment can be done through SIP (Systematic Investment Plan) also

• Invest as low as Rs. 500

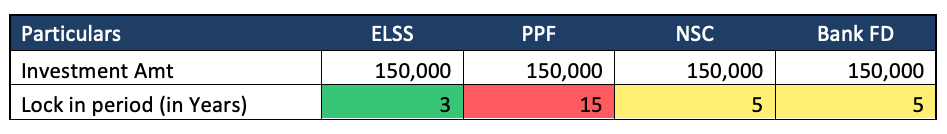

• Comparison of tax saving instruments u/s 80C

Take a mediclaim policy and save tax up to Rs. 7,800 * u/s 80D

• Deduction of Rs. 25,000 is available u/s 80D towards premium paid for self, spouse and dependent children

• If either you or spouse is a senior citizen i.e. age of 60 years and above, then this limit goes up to Rs. 50,000

• If premium is paid for parents who are senior citizen, additional deduction of Rs. 50,000 is available

* Income tax rate is assumed to be 30% + 4% cess